In today’s ever-evolving landscape, understanding insurance is more critical than ever. One of the leading concepts emerging within this domain is Insurance One—a comprehensive approach that simplifies the complexities typically associated with insurance products. This article aims to guide you through everything you need to know about Insurance One, from its definition to the various types of coverage available, the benefits of choosing Insurance One, and how to select the right plan for your needs. By the end of this guide, you’ll have a thorough understanding of Insurance One and be better equipped to make informed decisions about your insurance needs. What is […]

Nobar

Insurance NYC: Your Complete Guide to Coverage in the Big Apple

Navigating the insurance landscape in New York City (NYC) can be a daunting task, given the vast array of options and the unique challenges posed by urban living. From health insurance to auto coverage, understanding the various types of insurance available is crucial for safeguarding your personal and financial well-being. In this comprehensive guide, we will explore the different insurance options in NYC, how to choose the right coverage, and tips for saving money while ensuring you have the protection you need. By the end of this article, you will have a clearer understanding of insurance in NYC and the […]

Insurance Policy Lookup: A Comprehensive Guide to Finding Your Coverage

In today’s complex world of insurance, knowing how to access and understand your insurance policies is crucial for managing your financial security. Whether you’re trying to file a claim, update personal information, or simply keep track of your coverage, an insurance policy lookup is an essential tool that can help you navigate these tasks with ease. This guide will provide you with a detailed understanding of what an insurance policy lookup is, why it’s important, how to perform one, and tips for keeping your insurance information organized. By the end of this article, you’ll be equipped with the knowledge to effectively […]

Insurance 4 U 4 Less: Your Guide to Affordable Coverage

In today’s fast-paced world, having proper insurance coverage is essential for safeguarding your assets, health, and well-being. However, many people find themselves overwhelmed by the costs associated with various types of insurance. This is where the concept of Insurance 4 U 4 Less comes into play. Designed to help users find affordable insurance solutions tailored to their unique needs, Insurance 4 U 4 Less aims to demystify the insurance process and make it accessible to everyone.In this comprehensive guide, we will explore the different types of insurance available through Insurance 4 U 4 Less, how to get started with finding the […]

Insurance 360 – Everything You Need to Know About Insurance

Insurance is an essential part of financial planning that helps individuals and businesses manage risks and protect their assets. Understanding insurance from every angle, or adopting an “Insurance 360” approach, is key to making informed decisions that will safeguard your future. In this guide, we’ll dive into the details of insurance, cover all types of policies, and offer expert advice to help you select the best coverage. Whether you’re looking for life, health, auto, home, or business insurance, this guide will give you a complete view of the insurance world and how it affects your financial well-being. What is Insurance […]

Understanding Homeowners Insurance: A Comprehensive Guide

Homeownership is an exciting milestone, but it also comes with a set of responsibilities. One of the most crucial of these is ensuring that your home is adequately protected against unforeseen events. This is where homeowners insurance comes into play. Homeowners insurance is a form of property insurance that covers losses and damages to an individual’s house and assets in the home. It also provides liability coverage against accidents in the home or on the property.The significance of homeowners insurance cannot be overstated. It not only protects your physical dwelling but also covers your personal belongings and provides a safety net […]

Understanding the Insurance World: A Comprehensive Guide

The insurance world is a complex yet essential component of modern life, providing individuals, families, and businesses with financial protection against unforeseen risks. At its core, insurance is a mechanism for risk management that allows people to transfer the financial burden of potential losses to an insurance company. This transfer occurs through the payment of premiums, which are calculated based on the level of risk associated with the insured individual or entity.Insurance serves several vital purposes. It not only provides peace of mind but also plays a crucial role in financial planning. By having appropriate insurance coverage, individuals can protect their […]

Understanding the Differences: Insurance Broker vs Agent

Navigating the world of insurance can be complex and overwhelming, especially with the various professionals available to assist you. Among these professionals, insurance brokers and insurance agents play pivotal roles in helping individuals and businesses secure the coverage they need. However, many people are unsure about the key differences between an insurance broker vs agent and how each can impact their insurance experience.This article aims to clarify the roles of both insurance brokers and agents, explore their benefits and drawbacks, and help you make an informed decision when seeking insurance assistance. By understanding the distinctions between an insurance broker and an insurance agent, you can choose the right professional […]

The 9.99 Insurance Plan: Everything You Need to Know

In today’s fast-paced world, the need for accessible and affordable insurance options is more crucial than ever. One such option gaining traction is the 9.99 insurance plan, a cost-effective solution designed to provide essential coverage for individuals and families. With rising healthcare costs and varying insurance rates, understanding what the 9.99 insurance plan offers can empower consumers to make informed decisions. In this article, we will explore the ins and outs of the 9.99 insurance plan, including its features, benefits, potential drawbacks, and how it compares to traditional insurance options. By the end, you will have a comprehensive understanding of whether this plan […]

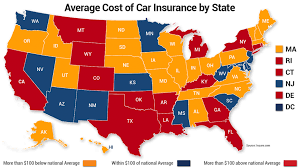

Insurance Rates by State: A Comprehensive Guide to Understanding Variations and Trends

Navigating the world of insurance can be a daunting task, especially when it comes to understanding how insurance rates by state can vary significantly. These rates are influenced by a multitude of factors, including state regulations, geographic conditions, and demographic trends. For consumers, comprehending these differences is crucial for making informed decisions about their insurance policies. In this comprehensive guide, we will delve into the nuances of insurance rates by state, exploring the factors that contribute to these variations, how to compare rates, and what resources can help you find the best deals. By the end of this article, you will have […]

Insurance Depot: Your Comprehensive Guide to Insurance Solutions

In today’s fast-paced world, navigating the vast landscape of insurance can be overwhelming. With countless providers, policies, and coverage options available, how do you find the right fit for your needs? This is where the concept of an insurance depot comes into play. An insurance depot serves as a centralized resource that simplifies the process of finding and comparing insurance options. This article will delve into what an insurance depot is, its benefits, how to choose the right one, and answer common questions surrounding this essential service. By the end of this guide, you will be well-equipped to make informed decisions […]

Finding Insurance Places Near Me: Your Comprehensive Guide

When it comes to securing your financial future, finding the right insurance coverage is essential. However, many individuals overlook the significance of selecting insurance places near me. Local insurance providers can offer personalized services and insights into your specific needs and circumstances. This article will guide you through the process of finding local insurance options, exploring the benefits of choosing nearby providers, and providing tips on how to make an informed decision regarding your insurance needs.As we delve into this guide, you will gain an understanding of why local insurance places matter, how to locate them effectively, what to consider […]

Understanding Insurance with No License: What You Need to Know

In today’s complex financial landscape, understanding the various forms of insurance is crucial for safeguarding your assets and ensuring peace of mind. However, one area that often raises eyebrows is the concept of insurance with no license. This term refers to situations where insurance is offered or sold without the proper regulatory approval and oversight. As tempting as it may seem to bypass traditional insurance avenues, the implications can be severe, leading to financial losses and legal troubles.This article aims to provide a comprehensive overview of insurance with no license, including its legal implications, the risks involved, how to identify […]

The Ultimate Guide to Insurance General: Everything You Need to Know

Insurance is a vital aspect of financial planning that provides protection against unforeseen events and risks. The realm of insurance general encompasses a broad spectrum of policies designed to safeguard individuals, families, and businesses from potential financial losses. Whether it’s protecting your home, car, health, or life, understanding the fundamentals of insurance general is crucial for making informed decisions.In this comprehensive guide, we will delve into the various types of insurance, how to choose the right policies, common misconceptions, and the future of the insurance industry. By the end of this article, you will have a clearer understanding of insurance general […]

Unlocking the Power of Insurance Leads: A Comprehensive Guide

What are Insurance Leads? Insurance leads are potential customers who have expressed interest in purchasing insurance products or services. These leads can come from various sources, including online inquiries, referrals, and events. Understanding what constitutes an insurance lead is essential for agents and agencies looking to grow their client base and enhance their sales strategies.Leads can be categorized based on their quality and intent: Cold Leads: Individuals who have not expressed interest in insurance but may be targeted through marketing efforts. Warm Leads: Prospects who have shown some interest, such as filling out a form or requesting a quote. Hot Leads: […]

Navigating the Road Ahead: A Comprehensive Guide to Insurance for Truckers

Legal Requirements for Trucking Insurance When it comes to the trucking industry, insurance for truckers is not just a good idea; it is a legal necessity. Most regions mandate that commercial trucking companies carry specific types of insurance coverage to ensure that both the drivers and the public are protected. For instance, in the United States, the Federal Motor Carrier Safety Administration (FMCSA) stipulates minimum liability insurance levels for different types of vehicles.Typically, the requirements include: $750,000 to $5 million in liability insurance for trucking companies, depending on the type of cargo transported. Cargo insurance to protect against the loss or damage of goods […]

Understanding Insurance for 50cc Mopeds: A Comprehensive Guide

Definition of a 50cc Moped A 50cc moped is a lightweight two-wheeled vehicle that typically features a small engine displacement of 50 cubic centimeters (cc). These vehicles are designed for short-distance travel and are often favored for their ease of use, fuel efficiency, and affordability. In many regions, mopeds are characterized by lower speed limits and specific design features, such as pedals or a restricted engine, that distinguish them from scooters and motorcycles. Popular Uses of 50cc Mopeds The versatility of 50cc mopeds makes them popular for various purposes. Here are some common uses: Commuting: Many individuals use 50cc mopeds for daily […]

Understanding the Insurance 2A Form: A Comprehensive Guide

The Insurance 2A Form is a specific document used in the insurance industry to facilitate various processes related to policy management, claims, and reporting. This form is particularly common in sectors such as health insurance, auto insurance, and property insurance. Its primary purpose is to collect essential information that ensures accurate processing of claims or adjustments to existing policies.This form typically includes sections for details such as the policyholder’s information, the type of claim being filed, relevant dates, descriptions of incidents, and any supporting documentation required. By standardizing the information collection process, the Insurance 2A Form helps streamline operations for both […]

Understanding Insurance House: A Comprehensive Guide to Home Insurance

An insurance house refers to the concept of protecting your home and its contents with a suitable insurance policy. Home insurance, also known as homeowners insurance, is a form of property insurance that provides financial protection against various risks that can damage or destroy your home. The purpose of home insurance is to safeguard one of your most significant investments—your house—by covering the costs associated with repairs, replacements, and liability claims.Home insurance typically covers damages resulting from fire, theft, vandalism, and certain natural disasters. It also protects your personal belongings, such as furniture, electronics, and clothing, against loss or damage. By […]

Insurance 50: Everything You Need to Know

Navigating the world of insurance can often feel overwhelming, with a myriad of terms and options that can leave anyone feeling confused. Among these terms, “Insurance 50” stands out as one that frequently raises questions. Understanding what “Insurance 50” entails is crucial for anyone looking to make informed decisions about their insurance needs. This article aims to demystify the concept of “Insurance 50,” exploring its meaning, history, types, benefits, and the role it plays in providing financial security. Whether you’re new to the world of insurance or looking to expand your current understanding, this comprehensive guide will equip you with […]

Understanding Insurance in Spanish: A Comprehensive Guide

In today’s diverse society, the need for clear communication across various languages has never been more critical. One area where this is particularly evident is in the realm of insurance. For Spanish-speaking individuals, understanding insurance terminology can often be a challenge, especially when navigating complex policies and legal jargon. This blog post will delve into the world of insurance in Spanish, providing essential insights, vocabulary, and resources to empower Spanish speakers in making informed decisions about their insurance needs. Why Understanding Insurance in Spanish is Important Insurance is a critical aspect of financial planning and risk management. It serves as […]

Insurance King Chicago Heights: Your Go-To Source for Coverage

In today’s world, securing the right insurance coverage is crucial for protecting your assets and ensuring peace of mind. Located in the heart of Chicago Heights, Insurance King is your trusted partner in navigating the often-complex world of insurance. With a commitment to providing personalized service and comprehensive coverage options, Insurance King has established itself as a leading choice for residents and businesses alike. Insurance King Chicago Heights offers a wide range of insurance products tailored to meet the diverse needs of its customers. Whether you’re a first-time insurance buyer, a seasoned homeowner, or a business owner looking to safeguard […]

Understanding Insurance in York, PA

Insurance plays a vital role in protecting individuals, families, and businesses from unexpected financial burdens. In York, PA, a city rich in history and community spirit, having the right insurance coverage is essential for ensuring peace of mind. This article explores various types of insurance available in York, PA, how to find the right coverage, answers to common insurance questions, and the future of the insurance industry in the area. Types of Insurance Available in York, PA Auto Insurance In Pennsylvania, auto insurance is mandatory, with drivers required to carry specific coverage to protect themselves and others on the road. […]

Understanding Insurance Guys: Your Go-To Resource for Insurance Solutions

Navigating the world of insurance can be a daunting task. With so many products, policies, and providers, it’s easy to feel overwhelmed. That’s where insurance guys come in. These professionals are your allies in understanding, selecting, and managing your insurance needs. In this article, we’ll explore the role of insurance guys, why they are important, how to choose the right one, and much more. What Are Insurance Guys? Insurance guys is a colloquial term that refers to professionals who specialize in the insurance industry. This includes insurance agents, brokers, and advisors who help individuals and businesses find appropriate coverage. They […]

Insurance Number

An insurance number is a unique identifier assigned to a policyholder by their insurance provider. It plays a critical role in the administration of insurance policies across various types of coverage, such as health, auto, or life insurance. Each type of insurance may have a different kind of number associated with it. For example, health insurance numbers are often linked to medical benefits, while auto insurance numbers are tied to vehicle policies. Understanding your insurance number is essential for several reasons, including efficient communication with your insurance provider, easy access to policy details, and prompt claims processing. Moreover, the insurance […]

Insurance 25: A Comprehensive Guide for Young Adults

Navigating the world of insurance can be a daunting task, especially for young adults who are just beginning to understand their options. Insurance 25 refers to the specific needs and considerations surrounding insurance policies for individuals around the age of 25. This is a crucial age as many young adults start to take on responsibilities such as driving, renting homes, or even starting families. Understanding the various types of insurance available and their importance can significantly impact financial stability and peace of mind. This article will delve into the various facets of insurance relevant to those around 25 years old, […]

Understanding Insurance Warehouse: A Comprehensive Guide

In today’s fast-paced insurance landscape, insurance warehouses have emerged as essential components that streamline the industry. They play a critical role in managing and distributing insurance products, making it easier for insurers, brokers, and consumers to access and utilize coverage. This blog post aims to provide a thorough understanding of what an insurance warehouse is, the types available, their benefits, key features, and future trends. What is an Insurance Warehouse? An insurance warehouse is a centralized hub where various insurance products and services are managed and distributed. Think of it as a vast repository that not only stores insurance policies […]

Insurance Help: Your Comprehensive Guide to Navigating Insurance Challenges

Insurance help refers to the various resources, services, and guidance available to individuals seeking assistance with their insurance needs. Whether you are trying to understand your coverage options, file a claim, or navigate complex insurance policies, having access to reliable information and support can make a significant difference. Insurance can often feel overwhelming due to its intricate terms, conditions, and processes. Therefore, seeking insurance help is crucial for making informed decisions, ensuring adequate coverage, and avoiding potential pitfalls in policy management. This article will explore the different types of insurance help available, where to find assistance, common questions regarding insurance […]

Understanding Insurance Benefit Administrators

Insurance benefit administrators play a crucial role in the management and delivery of employee benefits. They serve as the bridge between employers and employees, ensuring that the benefits provided meet the needs of the workforce while adhering to regulatory requirements. In this blog post, we will delve into the definition, responsibilities, and significance of insurance benefit administrators, exploring how they impact both employees and employers in today’s complex insurance landscape. What Are Insurance Benefit Administrators? Definition of Insurance Benefit Administrators Insurance benefit administrators are professionals or organizations tasked with managing employee benefits on behalf of employers. Their responsibilities include the […]

Insurance with No Down Payment – How to Get Affordable Coverage

In today’s financial climate, finding ways to save money is crucial, and insurance is one of the many areas where consumers are looking to cut costs. One popular option is insurance with no down payment, which offers flexibility for those who need coverage without the financial burden of a large upfront fee. Whether you’re looking for auto, health, or renters insurance, policies with no down payment can be a viable solution for those seeking immediate coverage with minimal financial strain. In this post, we’ll dive into what no-down-payment insurance means, how it works, and whether it’s the right option for […]