The Basics of Blackjack Blackjack is one of the most popular casino card games around the world, often played in both land-based and online casinos. The game’s objective is simple: beat the dealer’s hand without exceeding a total of 21. While the mechanics of the game are straightforward, the strategies involved can be complex. One such strategy is “insurance,” a side bet that can significantly impact your overall game strategy and outcomes. In this article, we will explore the concept of insurance in blackjack, its implications, strategies, and the mathematics behind it, providing you with a comprehensive understanding of this […]

Nobar

The Insurance Exchange of America: A Comprehensive Guide

The Insurance Exchange of America (IEA) plays a vital role in the modern insurance landscape. As a marketplace designed to facilitate the buying and selling of insurance products, it connects consumers with various insurance providers, ensuring they find coverage that meets their needs and budget. This article will delve deep into the IEA, exploring its structure, benefits, challenges, and the future of insurance exchanges in America. 1. What is the Insurance Exchange of America? The Insurance Exchange of America is fundamentally an online platform where individuals and businesses can compare insurance policies from multiple providers. This system aims to create […]

Understanding Insurance Offers Consumers: A Comprehensive Guide

In today’s complex financial landscape, insurance offers for consumers play a crucial role in protecting individuals and families against unexpected events. Insurance is more than just a safety net; it is a strategic tool designed to mitigate risks and provide peace of mind. Understanding the various insurance offers available can empower consumers to make informed decisions that enhance their financial security.Insurance offers can take many forms, from discounts on policies to comprehensive coverage plans tailored to specific needs. By comprehending the nuances of these offers, consumers can identify the best products that align with their unique situations. This guide will delve […]

Insurance for Self Employed: A Complete Guide

Navigating the world of insurance for self employed individuals can be daunting, yet it is an essential part of financial security for those who work for themselves. As a self employed person, you face unique challenges that differ significantly from those of traditional employees, particularly when it comes to securing adequate insurance coverage. Unlike employees who often receive insurance benefits through their employers, self employed individuals must take the initiative to find and purchase their own insurance policies, which can lead to confusion and uncertainty.The importance of having insurance as a self employed individual cannot be overstated. Without it, you may […]

Insurance Agents Near Me: Your Complete Guide to Local Insurance Solutions

When it comes to securing the right insurance, one of the most important steps you can take is to find insurance agents near me. These professionals serve as invaluable resources in navigating the complex world of insurance, offering expertise and personalized service tailored to your unique needs. Insurance agents act as intermediaries between you and insurance companies, helping you understand various policies, assess risks, and find the coverage that best fits your situation.The significance of working with local insurance agents cannot be overstated. Unlike online platforms that provide a one-size-fits-all approach, local agents have an intimate understanding of the community […]

Understanding Insurance Without a Car: A Complete Guide

In today’s world, not everyone owns a car. Whether it’s due to urban living, environmental concerns, or personal choice, many individuals rely on alternative forms of transportation such as bicycles, public transit, or even walking. This leads to a common question: what happens to your insurance needs when you don’t own a vehicle? Understanding insurance without a car is crucial for individuals who seek to protect themselves from unforeseen risks and liabilities.Insurance without a car addresses the needs of those who do not have a vehicle but still require coverage for various situations. This type of insurance can encompass a range […]

Understanding Insurance Quotes in California: A Comprehensive Guide

Navigating the world of insurance can often feel overwhelming, especially in a state as diverse and populous as California. One of the most crucial steps in securing the right insurance coverage is obtaining insurance quotes. This guide will walk you through everything you need to know about insurance quotes in California, ensuring you make informed decisions that best suit your needs. What are Insurance Quotes? Definition of Insurance Quotes Insurance quotes are estimates provided by insurance companies that outline the potential costs of various insurance policies based on specific criteria. These quotes take into account factors such as your personal information, the […]

A Comprehensive Guide to Insurance Tracking in Florence, SC

Navigating the world of insurance can be a daunting task, especially in a unique market like Florence, South Carolina. Insurance tracking is a fundamental practice that allows individuals and businesses to manage their insurance policies effectively. This guide will provide you with in-depth knowledge about insurance tracking in Florence, SC, its importance, methods to implement, and common challenges faced. What is Insurance Tracking? Definition of Insurance Tracking Insurance tracking refers to the process of monitoring and managing various insurance policies throughout their lifecycle. This includes keeping accurate records of policy details, renewal dates, claims made, and any changes in coverage. By actively […]

A Comprehensive Guide to Insurance Policy Numbers

Navigating the world of insurance can sometimes feel overwhelming, especially when it comes to understanding the intricacies of your policy. One of the most critical components of your insurance documentation is the insurance policy number. This guide is designed to provide you with comprehensive information about insurance policy numbers, their importance, how to find them, and much more. What is an Insurance Policy Number? Definition of an Insurance Policy Number An insurance policy number is a unique identifier assigned to your insurance policy by your insurance provider. This number serves as a reference point for both you and the insurer, enabling easy […]

A Comprehensive Guide to Insurance Rates by Car Model

Understanding insurance rates by car model is crucial for anyone considering purchasing a vehicle or looking to manage their insurance costs effectively. Insurance premiums can vary significantly based on the car you drive. This guide will delve into the factors that influence these rates, how to compare them, and tips for finding affordable options. What Are Insurance Rates by Car Model? Definition of Insurance Rates by Car Model Insurance rates by car model refer to the premiums charged by insurance companies based on the specific vehicle being insured. Each car model has its own set of characteristics that can affect its insurance […]

A Comprehensive Guide to Insurance Quote Progressive

Obtaining an insurance quote from Progressive is a vital step for anyone looking to secure auto insurance coverage. Progressive is one of the largest auto insurance providers in the United States, known for its competitive pricing and innovative insurance solutions. This guide will walk you through what an insurance quote is, how to get one from Progressive, the factors that influence your quote, and how to compare it effectively with other options available in the market. What is an Insurance Quote Progressive? Definition of an Insurance Quote An insurance quote is an estimate provided by an insurance company that indicates how much a […]

A Comprehensive Guide to Insurance Stocks

Investing in insurance stocks can be a rewarding opportunity for those looking to diversify their portfolios and tap into a sector known for its stability and potential for growth. This guide will explore the intricacies of insurance stocks, how they operate, the factors that influence their performance, and strategies for investing wisely in this vital sector of the economy. What Are Insurance Stocks? Definition of Insurance Stocks Insurance stocks refer to shares of publicly traded companies that provide various types of insurance coverage, including life, health, property, and casualty insurance. When investors buy these stocks, they are essentially purchasing a stake in […]

The Essential Guide to Insurance ID Numbers

Understanding the concept of an insurance ID number is crucial for anyone navigating the world of insurance. This unique identifier not only represents your relationship with your insurance provider but also plays a vital role in accessing the benefits and services that you are entitled to under your policy. In this comprehensive guide, we will delve into the meaning of the insurance ID number, its importance, how to find yours, and much more. What is an Insurance ID Number? Definition of Insurance ID Number An insurance ID number is a unique identifier assigned to each policyholder by their insurance company. This number is […]

Understanding Insurance for Military Families: Your Essential Guide

Insurance plays a vital role in ensuring the security and well-being of families, particularly for those who serve in the military. Insurance for military families encompasses a wide range of coverage options designed to meet the unique needs of service members and their loved ones. The military lifestyle often comes with its own set of challenges, including frequent relocations, deployments, and the need for specific coverage that addresses the risks associated with military service.For military families, having the right insurance is not just important—it’s essential. The unpredictability of military life can lead to unexpected financial burdens, making it crucial to have […]

Discover Insurance King on Rockton: Your Go-To Resource for Insurance Needs

In today’s world, having the right insurance coverage is not merely a safety net—it’s a solid foundation for financial stability and peace of mind. Insurance King on Rockton embodies this principle by providing a comprehensive suite of insurance solutions tailored to the unique needs of residents and businesses in the Rockton area. Whether you’re a homeowner looking to protect your investment, a driver seeking affordable auto insurance, or a business owner needing the right coverage to safeguard your operations, Insurance King is here to help.Founded with the mission of making insurance accessible and understandable, Insurance King on Rockton stands out in […]

What is Insurance 24/7? A Complete Overview

In today’s fast-paced world, the need for immediate assistance and support is paramount, especially when it comes to insurance. This is where insurance 24/7 comes into play. But what exactly is insurance 24/7? At its core, insurance 24/7 refers to the ability to access insurance services at any hour of the day or night, providing customers with the convenience and support they need, whenever they need it.The importance of 24/7 access to insurance services cannot be overstated. Whether it’s filing a claim after an accident, seeking clarification about a policy, or managing your account, having round-the-clock access can significantly enhance the […]

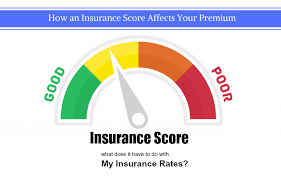

What is an Insurance Score? A Comprehensive Guide

An insurance score is a numerical representation that insurance companies use to assess the risk an individual represents when applying for insurance coverage. It plays a pivotal role in determining the premiums you will pay for various types of insurance, including auto, homeowners, and even life insurance. Understanding your insurance score is essential not only for securing affordable premiums but also for ensuring you are accurately represented in the underwriting process.Insurance companies utilize insurance scores as part of their broader risk assessment strategy. By analyzing data points that indicate your likelihood of filing a claim, they can make informed decisions about […]

Understanding the Concept and Benefits

In today’s fast-paced world, efficiency is key, especially when it comes to essential services like insurance. Insurance Xpress emerges as a revolutionary solution designed to streamline the insurance process, making it faster and more user-friendly for consumers. Understanding what Insurance Xpress is and how it works can significantly enhance your experience with insurance services.Insurance Xpress refers to a digital platform or service that simplifies the insurance claims process, allowing users to file claims quickly, track their status in real-time, and receive support whenever needed. This innovative approach addresses the common pain points associated with traditional insurance processes, such as lengthy paperwork, prolonged […]

Insurance Claims: A Comprehensive Guide to Navigating the Process

When unexpected events occur—be it an accident, natural disaster, or health issue—insurance claims become a crucial part of financial recovery. An insurance claim is a formal request made by a policyholder to their insurance company for compensation or coverage for a loss as outlined in their policy. Understanding the intricacies of insurance claims is essential for anyone who holds an insurance policy, as it can significantly impact the outcome of the claim and the financial relief that follows. Types of Insurance Claims Insurance claims can vary widely depending on the type of coverage one holds. Here are some common types of […]

Insurance Masters: A Comprehensive Guide to Mastering the Insurance Industry

In the intricate world of the insurance industry, the term insurance masters refers to professionals who have attained a high level of knowledge, skills, and expertise in various aspects of insurance. These individuals are pivotal in shaping the landscape of the insurance sector, as they play crucial roles in managing risks, underwriting policies, handling claims, and serving clients. The importance of insurance masters cannot be overstated; they ensure that the industry operates smoothly and meets the needs of policyholders while maintaining profitability for insurers.Insurance masters typically come from diverse backgrounds, combining education, experience, and continuous professional development to excel in their […]

The Insurance Estimator: A Comprehensive Guide

An insurance estimator is a professional or tool that assesses and calculates the value of damages or losses related to an insurance claim. This role is crucial in the insurance industry, as it helps determine the financial compensation that policyholders are entitled to when they experience a loss. By providing accurate and unbiased estimates, insurance estimators assist both consumers and insurers in navigating the complexities of claims processing.The significance of insurance estimators cannot be overstated. For consumers, especially those who have suffered losses due to accidents, natural disasters, or other unforeseen events, having an accurate estimation of their damages is vital. […]

The Insurance Marketplace: A Comprehensive Guide

The term insurance marketplace refers to a platform or environment where individuals and businesses can compare and purchase various types of insurance policies. These marketplaces serve as a bridge between consumers seeking insurance coverage and insurers offering those policies. The importance of the insurance marketplace cannot be overstated; it provides a streamlined process for consumers to access a range of insurance products, enabling them to make informed choices based on their needs and budgets.In the landscape of insurance, the marketplace plays a vital role in facilitating competition among insurers, which often leads to better pricing and products for consumers. By aggregating […]

Insurance Effective Date: What You Need to Know

In the world of insurance, understanding the insurance effective date is crucial for any policyholder. But what exactly does this term mean? The effective date of an insurance policy is the date on which the coverage begins. This date signifies the point at which the insurer assumes financial responsibility for covered events, which means that if something happens after this date, the policyholder can file a claim.Understanding your insurance effective date is not just a matter of knowing when your coverage kicks in; it can significantly affect your financial security and peace of mind. For instance, if you think your coverage starts on […]

A Comprehensive Guide to Insurance Cards: What You Need to Know

In today’s fast-paced world, having an insurance card is essential for anyone who holds an insurance policy. An insurance card serves as proof of your coverage and outlines critical details about your policy. It can be a lifeline during emergencies, helping you access healthcare services, auto repairs, or homeowners assistance. This article will guide you through the ins and outs of insurance cards, from their definition and components to how to obtain and use them effectively. By the end of this guide, you will have a solid understanding of insurance cards and their importance in managing your insurance needs. What is […]

Insurance House Login: A Comprehensive Guide

In today’s fast-paced world, managing your insurance needs efficiently is more important than ever. Insurance House has emerged as a key player in the insurance industry, offering a wide array of services to help individuals and businesses safeguard their assets and well-being. With the growing trend towards digital solutions, accessing your insurance information and managing policies online has become a necessity. What is Insurance House? Insurance House is a comprehensive insurance provider that offers various products, including auto, home, health, and life insurance. Founded on the principles of reliability and customer service, Insurance House aims to protect what matters most to its […]

A Comprehensive Guide to Insurance Riders: Enhancing Your Coverage

In the world of insurance, one size does not fit all. This is where an insurance rider comes into play. An insurance rider is an additional provision that modifies the terms of a standard insurance policy. By adding a rider, policyholders can customize their coverage to better meet their unique needs and circumstances. Whether you’re looking to protect your family, your home, or your vehicle, understanding insurance riders can be crucial for ensuring adequate protection.In this comprehensive guide, we will explore what insurance riders are, the different types available, why you might consider adding one to your policy, and how to […]

The Ultimate Guide to Insurance for Tesla: Protecting Your Electric Vehicle

As electric vehicles continue to gain popularity, insurance for Tesla has become an essential topic for current and prospective Tesla owners. Tesla vehicles are not just ordinary cars; they represent a shift in technology, sustainability, and driving experience. With their unique design, advanced technology, and high repair costs, the insurance needs of Tesla owners differ significantly from those of traditional gasoline-powered vehicles.In this comprehensive guide, we’ll delve into the various aspects of insurance for Tesla, including coverage options, factors that affect premiums, and tips for finding the best insurance provider. Whether you’re driving a Tesla Model S, Model 3, Model X, […]

A Comprehensive Guide to Insurance in Yucca Valley: Finding the Right Coverage for Your Needs

When it comes to securing your financial future and protecting your assets, understanding insurance in Yucca Valley is paramount. From homeowners seeking protection for their property to businesses needing liability coverage, the right insurance can safeguard against unforeseen events. This guide aims to provide an in-depth look at various types of insurance available in Yucca Valley, how to choose the right policies, and the importance of working with local agents. Whether you are a long-time resident or a newcomer, this article will help you navigate the insurance landscape in Yucca Valley effectively.What is Insurance in Yucca Valley? Definition of Insurance Insurance is […]

Understanding the Role of an Insurance Agent: Your Guide to Finding the Right Coverage

Navigating the complex world of insurance can often feel overwhelming, especially for those who are unfamiliar with the various products available. This is where the expertise of an insurance agent becomes invaluable. An insurance agent acts as a bridge between consumers and insurance companies, helping individuals and businesses secure the coverage they need to protect their assets and manage risks. In this comprehensive guide, we will delve into the role of an insurance agent, the different types of agents, how to choose the right one, and much more. By the end of this article, you will have a clearer understanding of what an insurance agent does […]

Insurance 4 Less Near Me: Your Complete Guide to Affordable Coverage

Navigating the world of insurance can often feel daunting, especially when trying to find affordable options that suit your needs. Insurance 4 Less Near Me has emerged as a popular solution for individuals and families looking to secure coverage without breaking the bank. This guide aims to provide you with comprehensive information about Insurance 4 Less, including its benefits, types of insurance offered, and how to find the best options available in your local area. By understanding how to leverage Insurance 4 Less Near Me, you can make informed decisions that will help protect your assets and ensure peace of mind.What is Insurance […]