In the world of automotive insurance and vehicle ownership, few things are as important yet as misunderstood as the Vehicle Identification Number (VIN) and the process of conducting an insurance VIN check. This comprehensive guide will delve deep into the intricacies of VINs, their significance in the insurance industry, and how understanding them can save you time, money, and potential headaches. Whether you’re a first-time car buyer, a seasoned auto enthusiast, or simply looking to better understand your vehicle’s history and insurance implications, this article will provide you with the knowledge you need to navigate the complex world of insurance VIN checks.

1. Vehicle Identification Numbers (VINs)

A Vehicle Identification Number, commonly known as a VIN, is a unique 17-character code assigned to every motor vehicle when it’s manufactured. Think of it as your car’s fingerprint – no two vehicles in operation have the same VIN. This standardized system was introduced in 1981 by the National Highway Traffic Safety Administration (NHTSA) in the United States, and it has since become a global standard.

The VIN serves multiple purposes:

- It allows for the precise identification of individual vehicles.

- It provides a standardized method for tracking recalls, registrations, warranty claims, thefts, and insurance coverage.

- It helps in verifying a vehicle’s history, including accidents, repairs, and ownership changes.

For insurance companies, the VIN is a crucial piece of information. It allows them to accurately assess the risk associated with insuring a particular vehicle, determine appropriate premiums, and prevent insurance fraud.

According to the National Insurance Crime Bureau (NICB), VIN checks have played a significant role in reducing auto theft. In 1991, 1,661,738 vehicles were reported stolen in the U.S. By 2020, that number had decreased to 873,080, a reduction of nearly 47%, partly due to the effective use of VINs in tracking and recovering stolen vehicles.

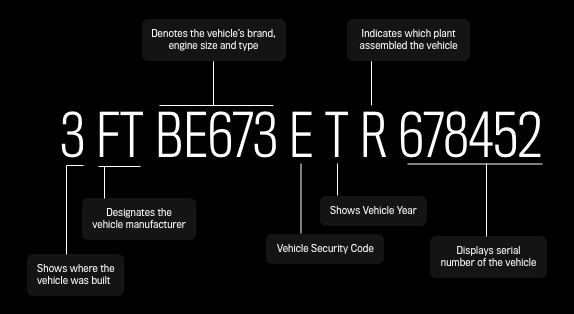

2. The Anatomy of a VIN: Decoding the 17 Digits

Understanding the structure of a VIN is crucial for anyone looking to conduct an insurance VIN check. Each of the 17 characters in a VIN represents specific information about the vehicle. Here’s a breakdown of what each section means:

- Characters 1-3: World Manufacturer Identifier (WMI)

- 1st character: Country of manufacture

- 2nd character: Manufacturer

- 3rd character: Vehicle type or manufacturing division

- Characters 4-8: Vehicle Descriptor Section (VDS)

- These characters describe the vehicle model, body style, engine type, etc.

- Characters 9-17: Vehicle Identifier Section (VIS)

- 9th character: Security check digit

- 10th character: Model year

- 11th character: Assembly plant

- 12th-17th characters: Production sequence number

For example, let’s decode the VIN 1HGCM82633A004352:

- 1 (Country): United States

- HG (Manufacturer): Honda

- C (Vehicle Type): Accord

- M82633 (Vehicle Attributes): Specific model details

- 3 (Check Digit): Validates the VIN

- A (Model Year): 2003

- 004352 (Serial Number): Unique to this vehicle

Understanding this structure allows insurers and vehicle owners to quickly glean important information about a vehicle without needing to physically inspect it.

3. The Importance of VINs in the Insurance Industry

In the insurance industry, VINs play a pivotal role in various processes, from underwriting to claims handling. Here’s why VINs are so crucial:

- Risk Assessment: VINs allow insurers to accurately determine the make, model, and specific features of a vehicle. This information is essential for assessing the risk associated with insuring the vehicle.

- Premium Calculation: The detailed vehicle information provided by the VIN helps insurers calculate appropriate premiums based on factors like the vehicle’s safety features, theft likelihood, and repair costs.

- Fraud Prevention: VINs help prevent insurance fraud by allowing insurers to verify the exact vehicle being insured and cross-reference it with databases of stolen or salvaged vehicles.

- Claims Processing: In the event of a claim, the VIN helps insurers quickly identify the specific vehicle involved and its coverage details.

- Recall Notifications: Insurance companies can use VINs to identify vehicles affected by manufacturer recalls, potentially preventing accidents and subsequent claims.

According to the Insurance Information Institute, auto insurance fraud costs the industry billions of dollars annually. The use of VIN checks has become a crucial tool in combating this issue, saving insurers and honest policyholders significant amounts of money.

4. How Insurance Companies Use VIN Checks

Insurance companies leverage VIN checks in various ways throughout their operations. Here’s a deeper look at how they utilize this valuable tool:

- Underwriting Process: When you apply for auto insurance, the insurer will typically ask for your vehicle’s VIN. They’ll then conduct a VIN check to verify the vehicle’s details and history. This information helps them assess the risk associated with insuring your vehicle and determine an appropriate premium.

- Claims Verification: When a claim is filed, insurers use the VIN to confirm that the vehicle involved in the incident matches the one on the policy. This helps prevent fraudulent claims involving misrepresented vehicles.

- Total Loss Evaluation: In cases where a vehicle is deemed a total loss, the VIN helps insurers accurately determine the vehicle’s actual cash value by considering its specific features and history.

- Stolen Vehicle Recovery: If an insured vehicle is stolen, the VIN is crucial in helping law enforcement locate and recover the vehicle.

- Salvage Title Identification: VIN checks can reveal if a vehicle has been previously declared a total loss and issued a salvage title, which significantly impacts its insurability and value.

- Safety Recall Alerts: Some insurance companies use VINs to track safety recalls and notify their customers, potentially preventing accidents and subsequent claims.

A study by the Highway Loss Data Institute found that certain vehicle models are more likely to be stolen or involved in accidents. By using VIN checks, insurance companies can identify these high-risk vehicles and adjust their underwriting practices accordingly.

5. Benefits of Conducting an Insurance VIN Check

Performing an insurance VIN check offers numerous benefits for both insurers and vehicle owners:

- Accurate Coverage: Ensures that your insurance policy accurately reflects your vehicle’s specifications, providing appropriate coverage.

- Fair Pricing: Helps insurers set fair premiums based on the vehicle’s actual features and history.

- Fraud Prevention: Protects you from unknowingly purchasing a stolen or salvaged vehicle.

- Hidden Damage Discovery: Can reveal previous accidents or damage that might not be visible during a physical inspection.

- Recall Awareness: Informs you about any open recalls on your vehicle, helping you maintain its safety.

- Ownership History: Provides insight into the number of previous owners and the vehicle’s usage history.

- Lemon Law Protection: Can reveal if a vehicle has been subject to multiple repairs under warranty, potentially qualifying it as a “lemon” in some states.

- Informed Decision Making: Equips you with comprehensive information to make informed decisions about purchasing or insuring a vehicle.

According to Carfax, a leading provider of vehicle history reports, one in every five vehicles on the road has an open recall. Regular VIN checks can help identify these issues, potentially saving lives and preventing costly repairs.

6. Step-by-Step Guide to Performing an Insurance VIN Check

Conducting an insurance VIN check is a straightforward process. Here’s a step-by-step guide:

- Locate the VIN: Find your vehicle’s VIN. It’s typically located on the driver’s side dashboard, visible through the windshield, or on the driver’s side door jamb.

- Choose a VIN Check Service: Several options are available:

- National Insurance Crime Bureau (NICB): Offers a free VINCheck service.

- National Motor Vehicle Title Information System (NMVTIS): Provides basic information for a small fee.

- Commercial services like Carfax or AutoCheck: Offer more comprehensive reports for a higher fee.

- Enter the VIN: Input the 17-digit VIN into the chosen service’s search field.

- Review the Report: Carefully read through the provided information, which may include:

- Accident history

- Title information

- Odometer readings

- Previous owners

- Recall notices

- Theft records

- Verify Information: Cross-reference the VIN check results with the physical vehicle and any documentation provided by the seller.

- Consult with Your Insurer: Share the VIN check results with your insurance company to ensure accurate coverage and pricing.

Remember, while VIN checks provide valuable information, they’re not infallible. Some incidents may not be reported, and there can be delays in updating databases. It’s always best to combine a VIN check with a professional inspection when considering a vehicle purchase.

7. Common Issues Revealed by VIN Checks

VIN checks can uncover a variety of issues that might affect a vehicle’s insurability, value, or safety. Some common revelations include:

- Salvage Titles: Indicates the vehicle was previously declared a total loss by an insurance company.

- Flood Damage: Reveals if the vehicle has been damaged by flooding, which can cause long-term issues.

- Odometer Rollback: Shows discrepancies in reported mileage, suggesting potential fraud.

- Multiple Owners: A high number of previous owners in a short time might indicate underlying issues.

- Accident History: Reveals reported accidents, which could affect the vehicle’s structural integrity and value.

- Manufacturer Buybacks: Identifies vehicles repurchased by manufacturers under lemon laws.

- Open Recalls: Highlights any unaddressed safety recalls issued by the manufacturer.

- Theft Recovery: Shows if the vehicle was previously stolen and recovered.

- Title Washing: Uncovers attempts to conceal a vehicle’s history by transferring it across state lines.

- Inconsistent Vehicle Use: Reveals if a personal vehicle was used as a taxi, rental, or police car, which could affect its wear and tear.

According to a study by Carfax, nearly 40% of used cars have some type of damage history. VIN checks help bring these issues to light, allowing buyers and insurers to make more informed decisions.

8. VIN Checks and Insurance Premiums: What’s the Connection?

The information revealed by a VIN check can significantly impact your insurance premiums. Here’s how:

- Vehicle Value: The exact make, model, and trim level identified by the VIN helps insurers accurately determine the vehicle’s value, affecting comprehensive and collision coverage premiums.

- Safety Features: VINs reveal specific safety features like airbags, anti-lock brakes, and electronic stability control, which can lead to discounts on premiums.

- Vehicle History: A history of accidents or damage can increase premiums due to perceived higher risk.

- Theft Risk: Some vehicles are more prone to theft. The VIN allows insurers to identify these high-risk models and adjust premiums accordingly.

- Salvage Status: Vehicles with salvage titles often cost more to insure due to increased risk and uncertain vehicle condition.

- Manufacturer Recalls: Unaddressed recalls might lead to higher premiums or coverage restrictions until resolved.

- Vehicle Age: The model year identified by the VIN helps insurers factor in depreciation and potential maintenance issues.

- Performance Capabilities: High-performance vehicles identified through VIN checks may incur higher premiums due to increased accident risk.

A study by Insurance.com found that the average annual car insurance premium in the U.S. is $1,674. However, this can vary significantly based on the specific vehicle and its history, as revealed by VIN checks.

9. Legal Aspects of VIN Checks and Insurance

VIN checks intersect with various legal considerations in the insurance industry:

- Truth in Lending Act: Requires disclosure of a vehicle’s VIN in financing agreements, ensuring transparency in insurance and loan processes.

- Anti-Theft Act: Mandates the use of VINs to combat vehicle theft and insurance fraud.

- Odometer Disclosure Requirements: VINs play a crucial role in tracking and reporting vehicle mileage, as required by federal law.

- Salvage Title Laws: VIN checks help enforce state laws requiring disclosure of salvage status, which affects insurance coverage.

- Privacy Laws: Insurance companies must handle VIN data in compliance with privacy regulations like the Gramm-Leach-Bliley Act.

- Insurance Fraud Laws: VINs are key in identifying and prosecuting various forms of insurance fraud.

- Lemon Laws: VIN checks help enforce state lemon laws by tracking repair histories and manufacturer buybacks.

- Recall Compliance: Some states are considering laws requiring open recalls to be addressed before a vehicle can be insured or registered.

The National Highway Traffic Safety Administration reports that VIN-based recall completion rates average around 75%. Some lawmakers are pushing for stricter enforcement to increase this rate and improve overall vehicle safety.

10. Case Studies: Real-Life Scenarios Involving Insurance VIN Checks

To illustrate the importance of insurance VIN checks, let’s examine a few real-life scenarios:

Case Study 1: The Hidden Salvage Title John was looking to buy a used car and found a great deal on a 2015 Toyota Camry. The car looked pristine, and the seller provided a clean-looking vehicle history report. However, when John’s insurance company ran a VIN check, they discovered the car had a salvage title from another state. The seller had engaged in title washing, moving the car across state lines to obscure its history. Thanks to the insurance VIN check, John avoided purchasing a potentially unsafe vehicle and saved himself from future insurance complications.

Case Study 2: The Unaddressed Recall Sarah had been insuring her 2012 Honda Civic for years without incident. During a routine policy renewal, her insurance company conducted a VIN check and discovered an open recall for a faulty airbag inflator. Sarah was unaware of the recall, which could have had deadly consequences if left unaddressed. The insurance company notified Sarah and temporarily adjusted her coverage until she had the recall issue resolved at a local dealership.

Case Study 3: The Odometer Fraud Mike was selling his car and provided the VIN to a potential buyer’s insurance company for a quote. The VIN check revealed a discrepancy in the reported mileage. It turned out that a previous owner had rolled back the odometer, a fact Mike was unaware of. This discovery not only affected the car’s value but also raised red flags for potential insurance fraud, even though Mike was not at fault.

These case studies highlight how insurance VIN checks can uncover crucial information, protecting both insurers and consumers from potential risks and fraudulent activities.

11. The Future of VINs and Insurance Technology

As technology continues to advance, the role of VINs in the insurance industry is evolving. Here are some trends and predictions for the future:

- Blockchain Technology: Some experts predict the use of blockchain to create immutable, decentralized records of vehicle histories linked to VINs, enhancing security and reducing fraud.

- AI and Machine Learning: Advanced algorithms will likely be developed to analyze VIN data more effectively, predicting risks and detecting anomalies with greater accuracy.

- Real-Time VIN Tracking: With the growth of connected cars, insurers may be able to access real-time data linked to VINs, allowing for more dynamic risk assessment and pricing.

- Integration with Telematics: VINs could become more closely linked with telematics data, providing a more comprehensive view of a vehicle’s usage and risk profile.

- Enhanced Vehicle Health Monitoring: Future VIN systems might incorporate more detailed data about a vehicle’s mechanical health, allowing for proactive maintenance and more accurate risk assessment.

- Global Standardization: As the automotive industry becomes increasingly global, there may be efforts to create a more universalized VIN system that works seamlessly across different countries and regions.

- Augmented Reality (AR) VIN Checks: AR technology could allow insurance adjusters or buyers to simply point their smartphones at a vehicle to instantly access its VIN and associated history.

- Integration with Smart Cities: As smart city infrastructure develops, VINs could play a role in traffic management, parking systems, and usage-based insurance models.

- Biometric Integration: Future vehicles might link VINs with biometric data of registered drivers, adding an extra layer of security and personalization to insurance policies.

According to a report by MarketsandMarkets, the global automotive VIN decoder market is expected to grow from $291 million in 2020 to $432 million by 2025, at a CAGR of 8.2%. This growth is driven by increasing vehicle production, rising vehicle thefts, and the growing trend of vehicle electrification and connectivity.

As these technologies develop, it’s likely that VIN checks will become even more integral to the insurance process, offering more comprehensive, real-time data that can be used to create highly personalized insurance products and enhance overall road safety.

12. Empowering Yourself with VIN Knowledge

In the complex world of automotive insurance, knowledge truly is power. Understanding the significance of Vehicle Identification Numbers (VINs) and how to leverage insurance VIN checks can empower you to make informed decisions, protect yourself from fraud, and ensure you’re getting the most appropriate insurance coverage for your vehicle.

Let’s recap the key points we’ve covered:

- VINs are unique 17-character codes that serve as a vehicle’s fingerprint, containing crucial information about its manufacturer, features, and history.

- Insurance companies rely heavily on VINs for risk assessment, fraud prevention, and accurate policy underwriting.

- Conducting a VIN check can reveal important information about a vehicle’s history, including accidents, theft, title status, and open recalls.

- The information uncovered by VIN checks can significantly impact insurance premiums and coverage options.

- VIN checks intersect with various legal considerations, including anti-theft laws, privacy regulations, and fraud prevention measures.

- As technology advances, the role of VINs in the insurance industry is likely to expand, offering even more detailed and real-time information about vehicles.

By understanding how to read a VIN and conduct a thorough VIN check, you’re better equipped to:

- Verify the true identity and history of a vehicle you’re considering purchasing

- Ensure you’re getting appropriate insurance coverage at a fair price

- Protect yourself from potential fraud or hidden issues with a vehicle

- Stay informed about important safety recalls that could affect your vehicle

Remember, while VIN checks are a powerful tool, they should be used in conjunction with other due diligence measures, such as professional inspections and test drives, when evaluating a vehicle. Additionally, always be sure to work with reputable insurance providers and use trusted sources for VIN checks to ensure the accuracy of the information you receive.

As we look to the future, the importance of VINs in the automotive and insurance industries is only set to grow. Staying informed about these developments can help you navigate the evolving landscape of vehicle ownership and insurance with confidence.

Whether you’re a car enthusiast, a casual driver, or an insurance professional, the knowledge you’ve gained about insurance VIN checks from this guide will serve you well in your automotive journey. Remember, a little research can go a long way in ensuring your peace of mind on the road.