Navigating the world of insurance can be a daunting task, especially when it comes to understanding how insurance rates by state can vary significantly. These rates are influenced by a multitude of factors, including state regulations, geographic conditions, and demographic trends. For consumers, comprehending these differences is crucial for making informed decisions about their insurance policies. In this comprehensive guide, we will delve into the nuances of insurance rates by state, exploring the factors that contribute to these variations, how to compare rates, and what resources can help you find the best deals. By the end of this article, you will have a clearer understanding of how to approach your insurance needs based on your location.

What Are Insurance Rates by State?

Definition of Insurance Rates

Insurance rates refer to the amount of money a customer pays to an insurance company for coverage. These rates are determined by various factors, including the level of coverage, the type of insurance, and the individual’s risk profile. For example, higher-risk individuals or properties will typically incur higher rates because they are more likely to file a claim.

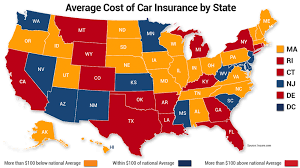

Overview of State Variations

Insurance rates can differ dramatically from one state to another. This variation can be attributed to several factors, including state laws, the frequency of natural disasters, and the overall claims history within the state. Understanding these state-specific dynamics is crucial for consumers seeking to choose the most cost-effective insurance options.For example, states with high populations and urban environments often see higher auto insurance rates due to increased traffic and a greater likelihood of accidents. Conversely, rural states may have lower rates due to fewer accidents and claims.

Factors Influencing Insurance Rates by State

State Regulations and Laws

Each state has its own set of insurance regulations that can greatly affect rates. Some states have stringent requirements for coverage, while others may have more relaxed standards. For instance, states that mandate no-fault insurance generally have higher rates because they require drivers to carry more coverage.Additionally, some states, such as California, have laws that limit how much insurance companies can raise rates, which can lead to a more stable pricing environment. In contrast, states without such regulations may experience more significant fluctuations in rates.

Geographic and Environmental Factors

Geography plays a significant role in determining insurance rates. States that are prone to natural disasters, such as hurricanes, wildfires, or floods, often have higher insurance rates due to the increased risk of claims. For example:

- Florida: Known for its hurricane risk, Florida has some of the highest homeowner’s insurance rates in the country.

- California: High wildfire risks have led to soaring homeowners and property insurance rates in certain regions.

In addition to natural disasters, geographic factors such as crime rates can also influence insurance costs. High-crime areas may see increased rates for auto and home insurance due to the higher likelihood of theft or vandalism.

Demographics and Population Density

Demographics and population density are critical factors affecting insurance rates by state. Urban areas typically experience higher rates due to increased traffic, higher claim frequencies, and a greater number of insured individuals. Conversely, rural areas tend to have lower rates because of fewer accidents and claims.For instance, states like New York and Illinois, which have large urban populations, often have higher auto insurance rates compared to rural states like Montana or Wyoming, where the risk of accidents is lower.

Claims History and Insurance Fraud

The claims history within a state can significantly impact insurance rates. States with a high frequency of claims often see higher rates as insurers adjust to manage their risk. For example, if a state has a high rate of auto accidents, insurers will raise premiums to cover the increased likelihood of payouts.Additionally, insurance fraud can lead to higher rates across the board. States with higher instances of fraud may see insurers increasing rates to compensate for the losses incurred from fraudulent claims.

Comparing Insurance Rates by State

Average Insurance Rates Across States

When it comes to comparing insurance rates by state, it’s essential to look at averages for various types of insurance, including auto, home, and health. Here’s a brief overview of average insurance rates (as of 2023):

| Insurance Type | Average Rate (National) | Highest Rate State | Lowest Rate State |

|---|---|---|---|

| Auto Insurance | $1,500/year | Michigan ($3,000) | Maine ($900) |

| Home Insurance | $1,200/year | Florida ($2,500) | Vermont ($900) |

| Health Insurance | $450/month | Alaska ($600) | Mississippi ($350) |

These averages illustrate how state-specific factors can lead to significant differences in insurance rates.

Top States with the Highest and Lowest Insurance Rates

Understanding which states have the highest and lowest insurance rates can help consumers make informed choices. Here’s a breakdown:

Highest Insurance Rates

- Michigan – Due to its no-fault insurance law, Michigan has some of the highest auto insurance rates in the country.

- Florida – High risk of hurricanes and high claim frequency contribute to elevated homeowner’s insurance rates.

- Louisiana – Frequent natural disasters and high claims from flooding lead to higher rates.

Lowest Insurance Rates

- Maine – A low population density and low claim frequency contribute to its low auto insurance rates.

- Vermont – Similar to Maine, Vermont has fewer claims and lower risks, resulting in lower rates.

- Ohio – Competitive insurance market and lower claim rates lead to affordable rates.

Discussion of Reasons Behind These Rankings

The reasons behind these rankings often stem from a combination of factors such as state regulations, environmental risks, and demographic trends. States with stringent regulations or high risk for natural disasters tend to have higher rates, while those with less risk and fewer regulations can offer lower rates.

How to Find Insurance Rates by State

Tools and Resources for Comparing Rates

Finding the best insurance rates requires utilizing various tools and resources. Some reliable websites that allow consumers to compare insurance rates by state include:

- NerdWallet – Offers comparison tools for auto and home insurance rates.

- Insure.com – Provides detailed information on state-specific rates and reviews of various insurance companies.

- The Zebra – Allows users to compare quotes from multiple insurers within their state.

Using these resources can help you gather the necessary information to make informed decisions and potentially save money on your insurance premiums.

Working with Insurance Agents

Consulting with insurance agents can also be beneficial in understanding rates specific to your state. Agents who specialize in your area will have in-depth knowledge of local insurance laws, regulations, and market practices. Here are some tips for finding knowledgeable agents:

- Ask for Recommendations: Seek referrals from friends and family who have positive experiences with local agents.

- Check Credentials: Ensure the agent is licensed and has a good standing with the state insurance department.

- Interview Multiple Agents: Don’t hesitate to speak with several agents to compare their knowledge, customer service, and rates.

Frequently Asked Questions about Insurance Rates by State

What are the main factors influencing insurance rates by state?

The main factors include state regulations, geographic and environmental risks, demographics, claims history, and instances of insurance fraud.

How can I find the best insurance rates in my state?

You can find the best insurance rates by comparing quotes from multiple providers, utilizing online comparison tools, and consulting with knowledgeable insurance agents.

Are insurance rates higher in urban areas compared to rural areas?

Generally, yes. Urban areas tend to have higher rates due to increased traffic and a higher frequency of claims, while rural areas usually see lower rates because of fewer accidents.

How often do insurance rates change by state?

Insurance rates can change frequently due to various factors, including changes in state regulations, claims history, and market competition. It’s important to review your rates annually.

What should I do if I find my insurance rates are significantly higher than the average in my state?

If you discover your rates are significantly higher, consider obtaining quotes from multiple providers, discussing your coverage options with your agent, and shopping around for better deals.

Conclusion

Understanding insurance rates by state is essential for consumers looking to make informed decisions about their insurance coverage. By recognizing the various factors that influence these rates, comparing options across states, and utilizing available resources, you can navigate the insurance landscape more effectively.Take the time to explore the insurance rates in your state, and don’t hesitate to seek assistance from professionals who can help you find the best coverage at the best price. By being proactive in your insurance shopping, you can ensure that you are making choices that align with your financial goals and protection needs.